2025 Form 1040 Schedule A Demo – Employees can only deduct their clothing expenses as miscellaneous uniform deductions on their Form 1040, Schedule A. They must also attach IRS Form 2106, Employee Business Expense or IRS Form . To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are .

2025 Form 1040 Schedule A Demo

Source : www.ocrolus.comBusiness tax deadlines 2025: Corporations and LLCs | Carta

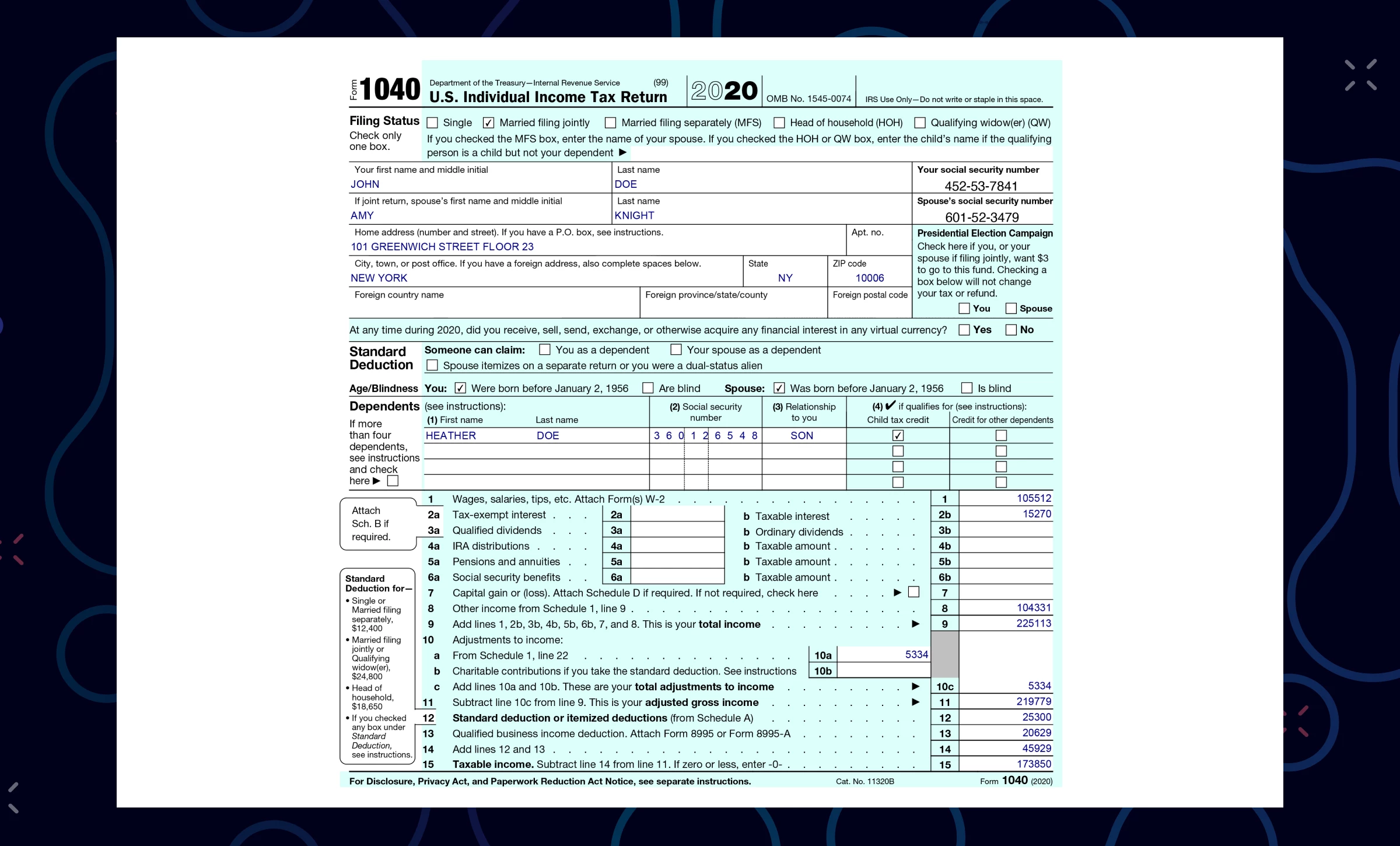

Source : carta.comIRS Form 1040 Automated Document Processing (2020, 2021)

Source : www.ocrolus.comIRS Demolition Yard Tour BOMA / GREATER LOS ANGELES

Source : infohub.bomagla.orgIRS Free File Now Open for 2025 Tax Season — Do You Qualify? | Money

Source : money.com2025 Form 1099 B Draft Comply Exchange

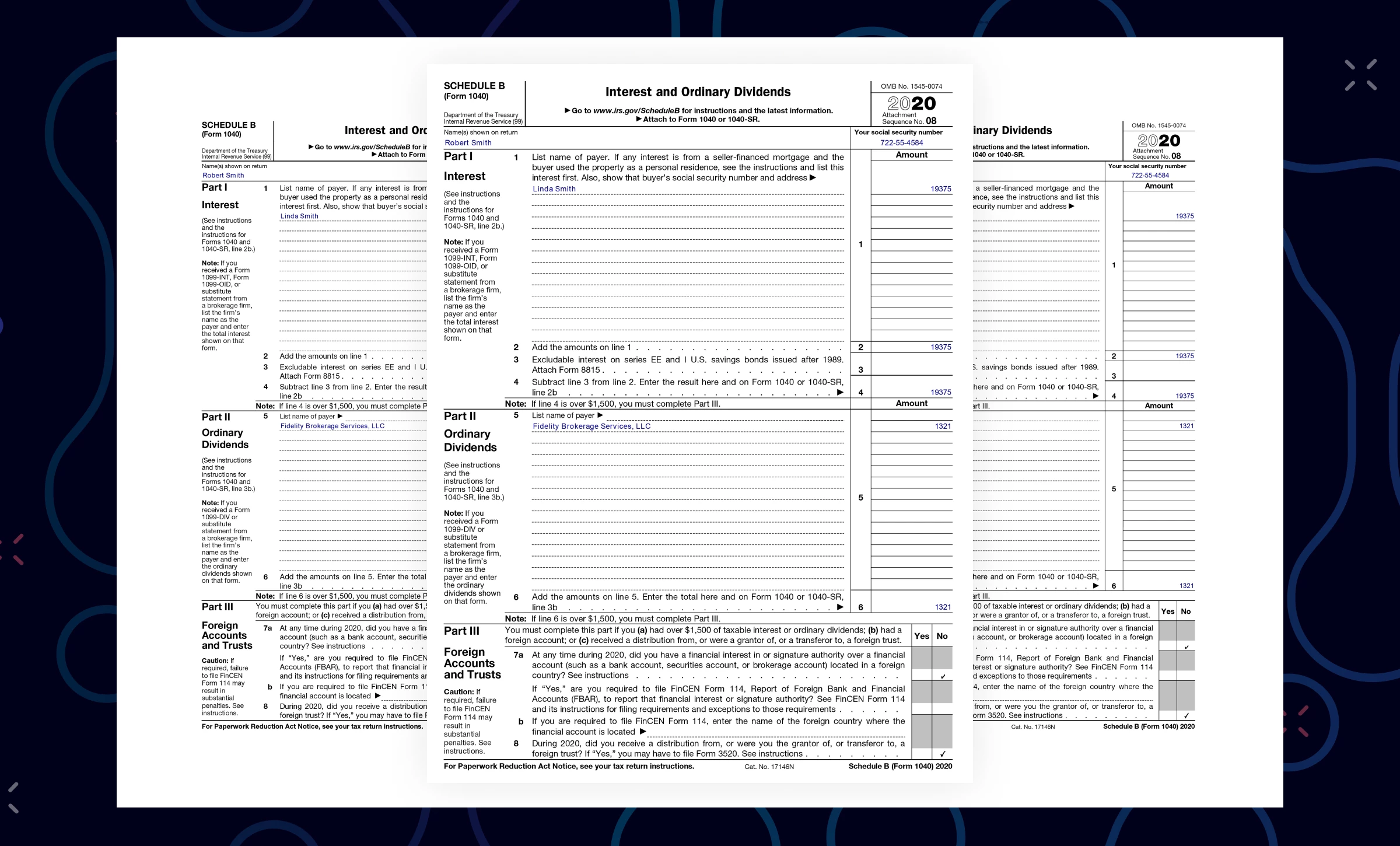

Source : www.complyexchange.comIRS Form 1040 Schedule B 2021 Document Processing

Source : www.ocrolus.comThe IRS Announces New Free File Guided Software for Taxpayers

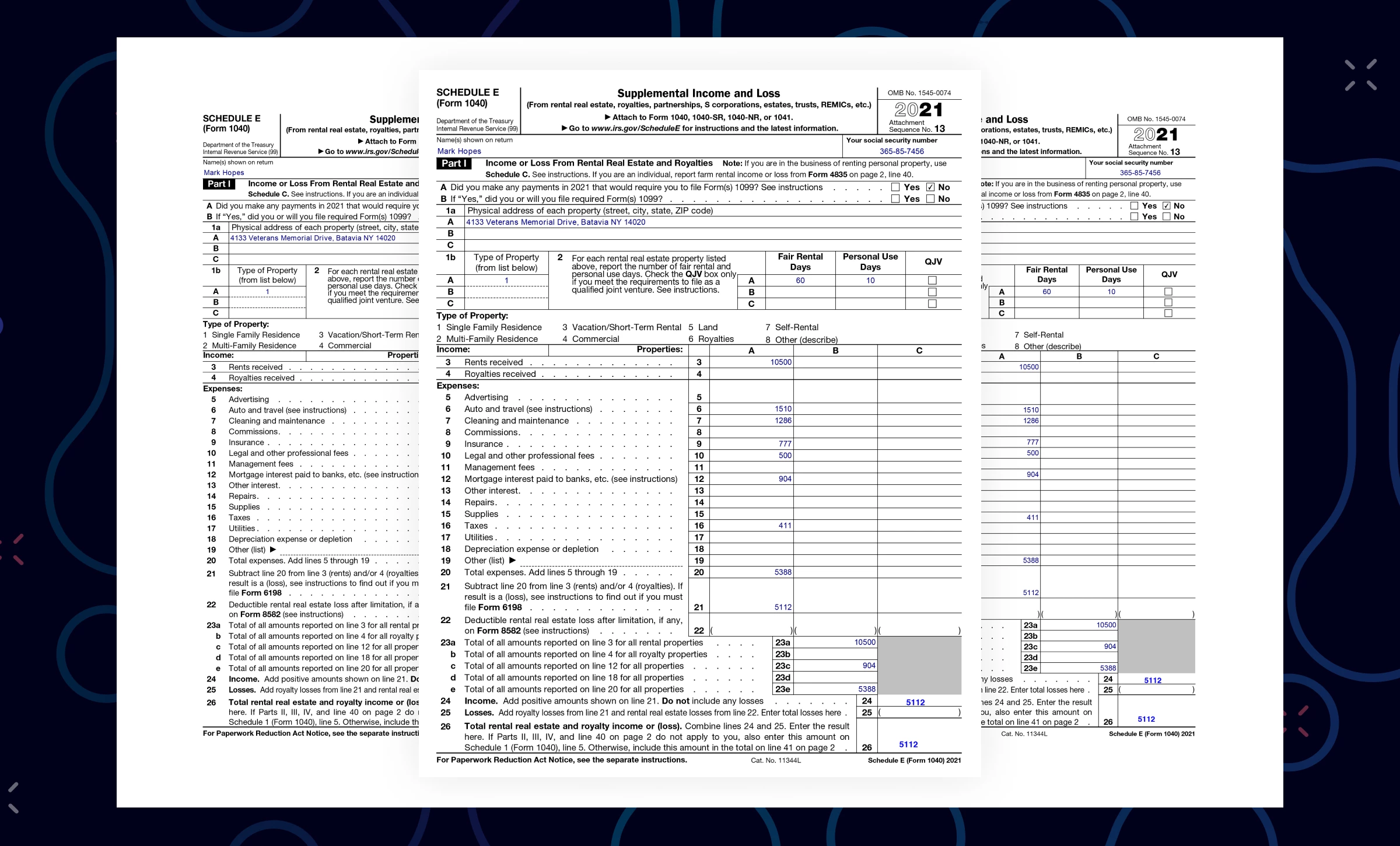

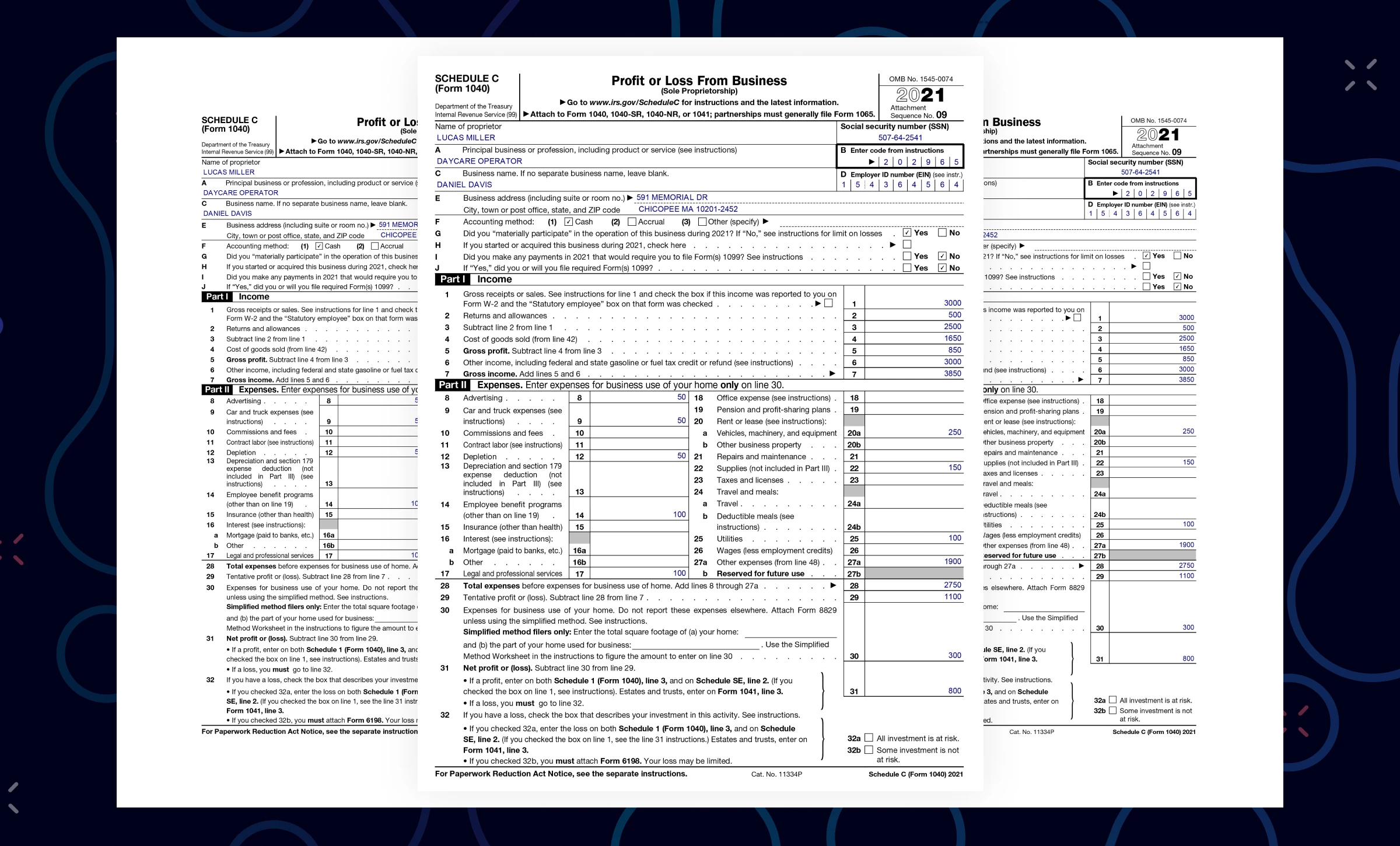

Source : saderlawfirm.comIRS Form 1040 Schedule C 2021 Document Processing

Source : www.ocrolus.comHow to Start a Tax Preparation Business from Home: 2025

Source : blog.taxdome.com2025 Form 1040 Schedule A Demo IRS Form 1040 Schedule B 2020 Document Processing: To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . In other words, taxpayers with uncomplicated tax situations will likely fill out Form 1040. Your 1040 will come with a number of schedules – like Schedule 1 and Schedule A – that are .

]]>